Start planning for retirementĪn HSA is a great tool to help you prepare for future health care costs and retirement. Unlike a 401(k) when you use HSA funds for qualified medical expenses - it’s always 100% income tax-free. In addition to contributing to your 401(k) you can also invest your HSA dollars to help grow your balance. This is a great way to plan for unexpected medical expenses, from your deductible to an ER visit, for the whole family. You can use your HSA to pay for the qualified medical expenses of anyone you claim on your taxes, even if you're only enrolled with single coverage. When you, your employer or anyone else makes a contribution to your HSA, it stays there so you can use it when you need it. You get to keep the money in your HSA, no matter what, even if you change jobs or move off a qualifying high-deductible health plan.

You know you're going to need it - so why not save on taxes, too? There is no "use it or lose it" rule

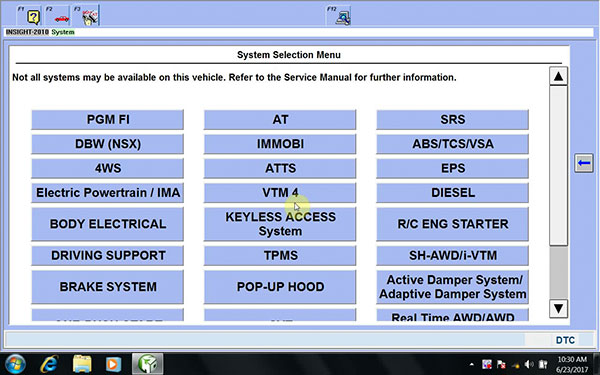

HONDA HDS LOGIN FREE

The money you contribute to your HSA goes in, grows and comes out income-tax free when used for qualified medical expenses. Federal and state laws and regulations are subject to change. This communication is not intended as legal or tax advice. Heath savings accounts (HSAs) are individual accounts offered or administered by Optum Bank, Member FDIC, and are subject to eligibility requirements and restrictions on deposits and withdrawals to avoid IRS penalties. Start taking charge of your healthcare savings and spending with an OptumBank Health Savings Account, an easy way to save smart. If your HSA is already up and running, contribute to it. So, don’t wait, if you don’t already have an HSA open one! (Additional Requirements included: Not enrolled in Medicare, not covered by any other health plan that…, covered under an IRS qualifying HDHP, may not be claimed as a dependent on another) The main requirement is that you’re covered under a qualifying high deductible health plan or HDHP.Īlthough there are additional requirements defined by the IRS. …that means the money in your account is yours to keep, even if you change jobs or health plans. (Graphic of ‘Use it or Lose it’ text breaking in half creating a tearing sound)

More good news, with an HSA there’s no use it or lose it rule, Second, you won’t pay income tax on money you use for qualified medical expenses, that includes vision and dental expenses.Īnd third, your savings grow income tax free, helping you create a nice little nest egg for retirement. Keep in mind the IRS sets limits on how much you can contribute each year. In fact, in most cases there are three ways an HSA helps you keep your money in your pockets and out of Uncle Sam’s.įirst, generally you won’t pay federal income tax on money you deposit into your account. If you are under the age of thirty years you are entitled to a 20% discount on select IHDS products and services.Save smart, it’s easy with an OPTUMBank® Health Savings Account or HSA.Īn HSA is used to save for qualified medical expenses for you and your eligible dependents, both now and in the future. Given this, IHDS is pleased to sponsor the Saturn Endowment. Saturn EndowmentĪs more and more young people are being attracted to the knowledge and its life transforming mechanics, IHDS recognizes that younger students seeking to enter an educational program may face material obstacles. If you are a Projector you are entitled to a 20% discount on selected IHDS products and services. IHDS is pleased to sponsor the Projector Endowment. Unlike energy Types, Projectors require extensive education which can be expensive.

Human Design recognizes the unique learning curve required by Projectors before they can fully begin to live out their experiment. Projectors are designed to master systems before they can truly recognize and be recognized. The IHDS Endowment is a special educational service of The International Human Design School.

0 kommentar(er)

0 kommentar(er)